SinoTech: U.S. Threatens Tariff Hike on Chinese Goods as Tech-Related Trade Issues Remain Unresolved

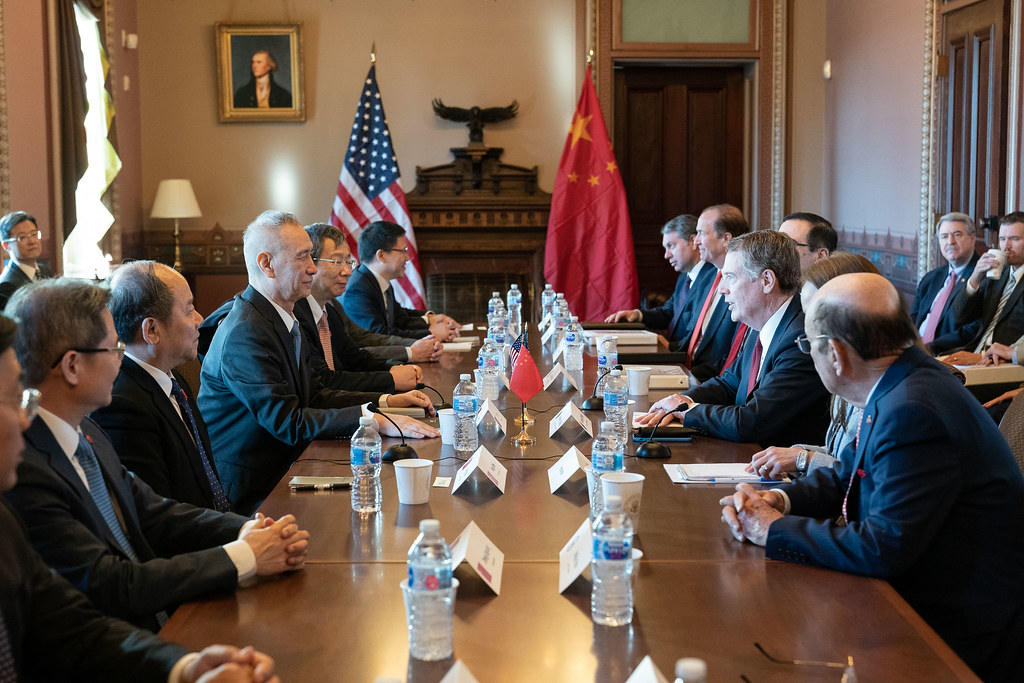

U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin concluded the 10th round of U.S.-China trade talks with Vice Premier Liu He on May 1. President Trump initially cast the negotiations as a success, but then tweeted on Sunday that he would raise the tariff rate on $200 billion worth of Chinese goods from 10 percent to 25 percent by week’s end.

U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin concluded the 10th round of U.S.-China trade talks with Vice Premier Liu He on May 1. President Trump initially cast the negotiations as a success, but then tweeted on Sunday that he would raise the tariff rate on $200 billion worth of Chinese goods from 10 percent to 25 percent by week’s end. Trump argued that trade deal negotiations with China were proceeding “too slowly” and that China was attempting to “renegotiate.” Yet even as Trump underscores the need to get over the finish line, American trade insiders have suggested that any final deal will do little to address American concerns about Chinese cyber intrusions and government subsidization of the economy.

The Financial Times reported that Trump, in his desire to reach a deal, has dropped the demand that China “halt alleged instances of commercial cyber theft.” Myron Brilliant, executive vice president at the U.S. Chamber of Commerce, has stated that Chinese negotiators insisted that the topic of cyber theft “be dealt with in a different forum.” The Trump administration has repeatedly accused China of violating the terms of the 2015 U.S.-China cyber agreement. As recently as April 26, FBI Director Christopher Wray warned that Chinese espionage spans “just about every industry or sector” and that “no country poses a broader, more severe intelligence collection threat than China.”

It would also appear that the United States has softened its stance on Chinese industrial policies. In past months, the Trump administration has sharply criticized “Made in China 2025,” China’s strategy to build competencies in 10 industrial sectors, in part through state subsidization. The president once warned that the strategy indicated China’s desire to “take over economically the world.” Yet on May 2, the New York Times reported that the proposed deal is “unlikely to resolve American concerns about China’s industrial policy.” Jeremie Waterman, head of the U.S. Chamber of Commerce’s China Center, notes that negotiators have made some progress on addressing national-level subsidies, but that Chinese subsidies at the provincial and local levels remain sticking points.

Chinese negotiators have made concessions in other sectors. China announced on Wednesday a slate of new measures that would open up its financial sector to foreign banks and insurers. Guo Shuqing, the chair of the China Banking and Insurance Regulatory Commission (CBIRC), unveiled a dozen measures broadly aimed at ensuring equality of treatment between domestic and foreign investors. The CBIRC policies will, among other provisions, loosen entry policies for foreign-invested financial firms to invest in and establish consumer finance companies. The CBIRC announcement led to an uptick in Hong Kong stocks, with the Hang Seng Index rising 0.8 percent.

The next round of trade talks will begin on Wednesday, May 8, in Washington, D.C. Vice Premier Liu is set to lead the Chinese delegation, composed of more than a hundred officials, as negotiators work to iron out final issues ranging from cloud computing regulations to large-scale purchases of American goods. Chinese officials, however, may well prove resistant to Trump’s pressure. As the South China Morning Post has reported, Taoran Notes, the public WeChat group that Beijing uses to release trade talk information, stressed that China and the U.S. may part in “unhappy departure” if the final deal isn’t fair to China.

Recent U.S. Government Reports Highlight Ongoing Concern About Technology Transfer

Two new reports—one released by the U.S. Trade Representative’s Office (USTR) and the other by the Department of Defense—signal that the U.S. government’s concerns about the economic and national security implications of intellectual property (IP) theft from China have not abated despite the passage in March of a new Chinese Foreign Investment Law with strengthened IP protections.

On April 25, the USTR released its 2019 Special 301 Report, an annual review of IP protection and enforcement in partner trading nations pursuant to Section 301 of the Trade Act of 1974. This year’s report features 36 countries with poor track records on IP, including a lengthy discussion of IP violations by China. According to the report, these violations included harms associated with market access conditioned on forced technology transfer as well as other ongoing challenges including “trade secret theft, online piracy and counterfeiting, the high-volume manufacture and export of counterfeit goods, and impediments to pharmaceutical innovation.” China also remains one of 11 countries on the USTR’s “Priority Watch List” of nations whose IP policies pose the greatest concern.

In particular, the report highlighted the need for broad structural change in the Chinese government’s approach to IP. The Chinese government recently undertook an administrative reorganization of the agencies responsible for IP protection and has implemented judicial reforms including the creation of a new specialized IP tribunal within the Supreme People’s Court. However, the USTR maintains that “these steps toward reform fall short of needed fundamental changes.” China also remains the top global source of counterfeit goods, and concerns about the sale of counterfeit goods through e-commerce continue to mount.

Concerns about military technology and IP theft were prominent themes of the Department of Defense’s Annual Report to Congress on Military and Security Developments Involving the People’s Republic of China. While the report covered a broad range of national security concerns, from naval power to influence operations, it highlighted the Chinese government’s emphasis on technological self-reliance, growing superiority in certain military technologies, and integration between civil and military technology producers. In particular, a section on “Foreign Technology Acquisition” described a series of criminal indictments by the Justice Department regarding the procurement and transfer to China of certain military and dual-use technologies including those related to “space communications, military communication jamming equipment, dynamic random access memory, aviation technologies, and anti-submarine warfare.” As these national security-related indictments suggest, economic espionage and forced technology transfer are clearly poised to be an ongoing thorn in the bilateral relationship.

In Other News

- An April 30 Bloomberg investigative report revealed that Vodafone, Europe’s biggest phone company, found “hidden backdoors” in Huawei-supplied equipment in 2011 and 2012. Bloomberg also released an April 2011 document in which Bryan Littlefair, Vodafone’s then chief information security officer, noted that Vodafone tests found continued security issues even after Vodafone contacted Huawei in 2011 about a vulnerability in home internet routers. In the document, Littlefair commented that Huawei’s “continued requests for us to give them a chance to prove their straight and honest approach takes a hit in this case when the demonstrated actions are nothing of the sort.” Huawei is currently Vodafone’s fourth-largest supplier. In response to the report, Vodafone maintained that there was “no evidence of any data being compromised.”

- British Prime Minister Theresa May fired Defense Minister Gavin Williamson on May 1 over a leak from the National Security Council revealing that May had decided, over the opposition of five ministers, to ban Huawei from supplying core segments of Britain’s planned 5G mobile phone network. In his response letter to May, Williamson denied involvement in the leak, arguing that a “thorough and formal inquiry would have vindicated my position.” May has noted that an internal inquiry was conducted and that the inquiry was “conducted in the way in which one would expect an inquiry of this sort to be conducted.” The Metropolitan Police have said that the leak does not amount to a criminal offense. In the meantime, May has named Penny Mordaunt as defense secretary.

- A recent Human Rights Watch report details how Chinese officials have used a mobile application to conduct mass surveillance in Xinjiang. Security forces have relied on innovative technologies in implementing the government’s “Strike Hard Campaign Against Violent Terrorism.” Police and government officials use the application to communicate with the Integrated Joint Operations Platform (IJOP), a system that “aggregates data about people and flags to officials those it deems potentially threatening.” IJOP “surveils and collects data on everyone in Xinjiang” and detects irregularities “from what it considers normal,” prompting authorities to launch an investigation. The report notes that many of the Chinese government’s surveillance practices in Xinjiang violate Chinese law as well as “internationally guaranteed rights to privacy, to be presumed innocent until proven guilty, and to freedom of association and movement.” The report closes with a battery of recommendations and calls on concerned governments to “impose targeted sanctions” against “Party Secretary Chen Quanguo and other senior officials linked to abuses in the Strike Hard Campaign.” Trump administration officials have evinced greater willingness to criticize Chinese activity in Xinjiang in recent months. On May 3, Randall G. Schriver, assistant secretary of defense for Indo-Pacific security affairs, in discussing the 2019 Defense Department report to Congress on China, termed the Communist Party’s camps in Xinjiang “concentration camps.”

- A recent NPR feature argued that “visas are the latest weapon in a growing rivalry between the U.S. and China.” The U.S. has canceled visas for prominent Chinese scholars and has delayed visas for “hundreds of Chinese students.” American academics have likewise continued to “fail to receive visas to China.” In his recent speech at the Council on Foreign Relations, FBI Director Christopher Wray noted that China is stealing innovation at least partially “through graduate students and researchers” and other “actors all working on behalf of China.” At one point, the Trump administration considered halting all student visas for Chinese nationals, though it ultimately backed off from such an extreme policy. A U.S. Embassy spokesperson told NPR that there is no “‘widespread’ campaign to deny visas to Chinese citizens” and that the U.S. “welcomes scholars … to conduct legitimate academic activities.” Meanwhile, the State Department’s director of policy planning, Kiron Skinner, came under criticism for her comments suggesting that U.S.-China competition is a “clash of civilizations” marking “the first time that we will have a great power competitor that is not Caucasian.”

Commentary

In the New York Times, Nick Frisch considers whether the level of technologically enabled surveillance in Xinjiang foreshadows broader risks of “illiberal innovation” from China. Joy Dantong Ma of the Paulson Institute lays out the data-driven case for why the United States’s path toward preeminence in artificial intelligence (AI) globally depends on continued openness to foreign talent. In Foreign Affairs, Paul Scharre describes the dangers inherent in an AI arms race. Kevin Rudd argues in the Washington Post that even if the United States and China reach a trade deal, that won’t resolve many aspects of the fraying bilateral relationship. The Center for Strategic and International Studies’s (CSIS) China Power Project examines the degree of internet penetration in China.

A series of articles by Gordon Chang, Michael Auslin and Niall Ferguson at the Hoover Institution outline the trajectory of Chinese power and influence. A new report from Brookings describes the new geopolitical dynamics in global infrastructure development emerging as a result of China’s Belt and Road Initiative (BRI), while Matthew Goodman and Daniel Runde at CSIS explore how the United States can respond to the global infrastructure challenge, including infrastructure projects financed under the BRI.

On Lawfare, Alexei Bulazel, Sophia d’Antoine, Perri Adams and Dave Aitel argue that an approach of risk mitigation with respect to 5G network equipment provided by Huawei is impossible both because the risks are incalculable and because “mitigation is impossible.” Meanwhile, Herb Lin responds with considerations about whether mitigation is truly impossible. James Miller and Neal Pollard offer support for a strategy of “persistent engagement” in cyberspace. Jessica Brandt and Bradley Hanlon advocate for a cross-platform approach by technology companies to information operations. On the National Security Law Podcast, Steve Vladeck and Bobby Chesney discuss recent indictments by the Justice Department related to counterespionage and China (at 1:02).