As the Coronavirus Ravages the United States, a Fragile Truce Between Beijing and Washington Takes Hold

Lawfare's biweekly roundup of U.S.-China technology policy news.

For weeks, as the novel coronavirus has torn through American cities, Chinese Communist Party (CCP) diplomats and the Trump administration had traded barbs, blaming each other for the pandemic. The sharp rhetoric had initially dimmed prospects for a cooperative response to the virus, which has infected over 1.5 million globally and claimed more than 90,000 lives. But both Beijing and Washington have abruptly changed course, adopting a conciliatory tone and promising cooperation. President Trump announced he would no longer refer to the coronavirus as “the Chinese virus” and later said that “[t]he relationship with China is a good one, and my relationship with [President Xi] is really good.” Cui Tiankai, Chinese ambassador to the United States, wrote an op-ed in the New York Times calling for cooperation: “We will remember that in our difficult days … Americans … offered us a helping hand. We stand ready now to repay their kindness and help them make it through too.”

Beyond the rhetorical detente, the two sides are working together to bring Chinese supplies to U.S. hospitals, many of which are desperate for masks and protective equipment. On March 29, the Federal Emergency Management Agency announced that the first of 22 planes chartered by the United States to bring medical equipment from China had landed in New York. The plane brought millions of masks and gloves, as well as thermometers and gowns.

To date, the federal government’s recent work to procure equipment from China has not been enough to meet demand in U.S hospitals. Critics point out that the Trump administration has also been slow to lift tariffs on many crucial medical supplies that U.S. health care providers import from China. For example, Ohio-based Purell sanitizer producer Gojo Industries was initially denied a tariff exemption for Chinese parts used in its products. The Office of the United States Trade Representative changed course only after Sen. Rob Portman of Ohio intervened on the company’s behalf.

And at least in part because the federal government has not set up a clear arrangement to purchase equipment on behalf of all states, governors and health care providers have scrambled to source their own equipment—often through China. In a high-profile example, Gov. Charlie Baker of Massachusetts struck a deal with a collection of Chinese manufacturers to acquire a million masks—and then convinced Patriots’ president Johnathan Kraft to send the football team’s private jet to Shenzhen, where it collected as much cargo as it could haul before flying back. Gov. Andrew Cuomo of New York announced that the Chinese government had facilitated a donation of 1,000 ventilators to the Empire State from Alibaba co-founders Jack Ma and Joe Tsai. In this frenzied atmosphere, not all purchases have gone smoothly. RWJBarnabas Health, New Jersey’s largest health care network, recently procured 500,000 masks from a nontraditional Chinese supplier—only to find that the masks were medically useless.

As the virus wreaks havoc in the United States and around the world, experts agree that further cooperation between Washington and Beijing will allow for a more coordinated response to the pandemic and help save lives. Recent conciliatory comments from both sides of the Pacific are encouraging. But it is not clear whether and to what extent the truce will extend to domains outside of the coronavirus response. American officials continue to advocate a hardline approach toward Beijing to counter its economic espionage and military expansion in Asia. Last week, in a move widely seen as targeting Chinese companies, the Trump administration formally established a committee responsible for reviewing bids by foreign enterprises to enter the U.S. telecommunications market. Trump also signed into law the Taiwan Allies International Protection and Enhancement Initiative (TAIPEI) Act, which requires the State Department to report to Congress on measures taken to improve U.S. diplomatic relations with Taiwan. In response, a spokesperson for China’s Foreign Ministry called the law a “crude” interference in China’s internal affairs, saying the United States would encounter a “resolute strike back by China” if it did not “correct its mistakes.”

Trump Administration Coalesces Around New Export Controls Against China

Trump administration officials, according to a Reuters report, have coalesced around a series of new policies to further prevent China from importing U.S. technology. Current U.S. policy prohibits selling technology to China for military use but generally allows exports for civilian purposes. Policymakers have agreed on three specific changes to the existing laws. The first would eliminate the “civilian exemption” that lets American firms sell certain goods, such as some semiconductors, to civilian Chinese importers even for nonmilitary use. A second policy would block China’s military from buying certain technologies—including airplane engines and some types of computers—regardless of their intended use. The final measure would require foreign companies to seek Washington’s approval before shipping certain U.S.-made technologies to China. Although officials have decided “to press ahead with their roll-out,” the report did not confirm whether Trump would sign off on these steps.

The new proposals, according to Reuters, reflect growing concerns within the Trump administration about China’s civil-military fusion. Civil-military fusion refers to China’s elimination of barriers between its defense and civilian sectors, such that its military can more efficiently leverage domestic private-sector research for its own purposes. U.S. policymakers worry that China’s civil-military fusion, by funneling American technology exports into the Chinese military’s hands, could erode the U.S. military edge. The Trump administration also fears U.S. allies are not taking this threat seriously enough. Reflecting the administration’s growing focus on the issue, State Department officials have publicly spoken and written about Chinese civil-military fusion over the past month.

In addition, the Reuters report states that senior officials have agreed on other measures to restrict global sales of semiconductors to Huawei specifically. These measures build on past Trump administration maneuvers to block exports to China. In May 2019, Trump placed Huawei on a trade blacklist. This blacklist, however, remains only partially implemented.

When asked about the rumored new Huawei restrictions, officials from Huawei and the Chinese government both said that if such policies were enacted, Beijing would retaliate. One government spokesperson objected to Washington’s “trumped-up” charges against Chinese companies and pledged China would “not sit idle” in the face of U.S. “bullying.” Similarly, Huawei chairman Eric Xu commented last week in an interview that “the Chinese government will not just stand by and watch Huawei being slaughtered.” Xu also speculated that Beijing might implement bans on American 5G and other telecom technologies. China and Huawei officials have consistently criticized U.S. restrictions against Huawei as an attempt to reduce its competitiveness.

Xu’s interview also revealed that, despite last May’s export ban, Huawei continued to purchase significant quantities of American goods. It spent $18.7 billion on U.S. components last year—a 70 percent increase from the year before. Commentators have taken this data to suggest that the U.S. export ban is relatively porous. Several factors may account for this. For one, the U.S. still lets exporters sell U.S. goods to Huawei, under a “general license,” in order to service products that are already developed. This allows U.S. telecom carriers, for instance, to sell Huawei goods it needs to maintain existing networks. Other U.S. companies, including semiconductor manufacturers, have avoided the ban by manufacturing significant portions of their products outside the United States. (The blacklist applies only to exports for which a threshold percentage of components are U.S. made.) The Department of Commerce also grants companies individual licenses to bypass the ban.

Xu did concede in his interview that U.S. sanctions have directly hurt the company. He credited the U.S. blacklist for causing Huawei to miss its revenue targets set last April—just before the ban took effect—by $12 billion. (Overall, the company performed well last year, with revenues growing 19 percent.) Xu also predicted that 2020 will be the company’s “most difficult year” yet, with both the coronavirus pandemic and U.S. sanctions taking a toll.

Although the U.S. and China have toned down hostile rhetoric during the coronavirus pandemic, these developments emerge as tensions over Huawei and China’s technology sector run high. The ongoing feud has seen the U.S. restrict use of Huawei technology in domestic cellular networks and pressure allies to do the same. China, meanwhile, has responded by marketing Huawei technology abroad. It has leveraged ad campaigns and offers of investment to win favor for Huawei across the world; at the same time, it has threatened “repercussions” against countries that shun Huawei’s 5G technology.

So far a number of America’s European allies, including the U.K., have chosen to grant Huawei a limited role in their 5G networks. However, U.K. politicians are reportedly reconsidering their January agreement to purchase Huawei-made 5G components, due to concerns with how China handled the coronavirus crisis.

In Other News

As part of a public diplomacy campaign, China has provided ventilators, protective equipment and medical supplies to countries in need around the world. Analysts have noted, however, that the aid may come with strings attached: Beijing may seek to use its “mask diplomacy” to stifle criticism of the CCP’s early missteps in addressing the coronavirus pandemic. Moreover, some of China’s donations have not gone as planned. A number of countries have said that supplies shipped to them from China were defective. The Netherlands recalled 600,000 masks provided by China after the country’s health ministry said they did not meet government standards. The Spanish government withdrew more than 60,000 coronavirus test kits over concerns about their accuracy (the Chinese government said later that the Chinese company that sold the kits was not an authorized manufacturer). In the Czech Republic, health authorities said that tests sourced from China detected the coronavirus only if the patient had already been infected with the virus for five days or more—and that fully a third of the tests they imported were otherwise defective. The Global Times, a CCP mouthpiece, published an editorial saying that the Chinese government would begin relevant investigations into domestic producers to ensure quality in its medical supply chains. But the piece warned that Western countries should not exaggerate the extent of the problem or else risk disrupting cooperation to fight the global pandemic.

The Chinese government has cautiously lifted some quarantine measures in an effort to reopen the economy more than two months after Beijing imposed stringent restrictions on travel and movement to fight the pandemic. The road ahead is uncertain: Beijing must contend with the possibility of a resurgence of the virus, as Chinese factories resume operations, stores reopen and businesses come back to life. In Hong Kong, where cases had for a long time remained low due to strong quarantine measures, coronavirus infections shot up when the government lifted some restrictions on movement in early March. Epidemiological concerns aside, much of the international and domestic demand for Chinese goods and services appears to have dried up as a result of the pandemic. Given these challenges, projections for China’s economic performance in 2020 are grim: Some analysts say GDP growth could fall to just 1 or 2 percent, down from 6 percent last year. Experts worldwide will be carefully monitoring coronavirus case reports and economic performance in China as the country goes back to work. Whether and how Beijing manages to contain a second wave of the virus will provide useful information for other countries on how to navigate the crisis once infection rates begin to stabilize.

As coronavirus infection rates soar in the United States, many Chinese students studying at U.S. universities have found themselves stranded far from home. Airline fares to China have skyrocketed, as the Chinese government has imposed measures to limit air traffic that could bring potentially infected travelers from the U.S. and Europe to China. Two hundred families of Chinese nationals studying in the United States signed an open letter to Cui Tiankai, Chinese ambassador to the United States, asking the Chinese government to arrange safe passage back to China. Open appeals from Chinese nationals to high-ranking Chinese officials are unusual, as the Chinese government has redoubled efforts in recent years to quash dissent and stifle public protests.

Commentary

The Washington Post’s editorial board discusses how the coronavirus pandemic has given China and Russia opportunities to spread misinformation. In the East Asia Forum, Ryan Hass and Kevin Dong explain how the coronavirus fallout is heightening tensions between the U.S. and China, and how that amplified disagreement creates negative outcomes for both countries. For The Diplomat, Sophie Mak argues that the coronavirus lockdown, and the corresponding surge in domestic violence cases in China, has revealed the ineffectiveness of China’s Anti-domestic Violence Law. In the Wall Street Journal, John P. Walters critiques China’s handling of the pandemic.

In Foreign Affairs, Minxin Pei writes that President Xi’s leadership has exposed the instability of the CCP, while Brad Setser advocates for a stronger social safety net in China. For the Council on Foreign Relations, Perri Adams, Dave Aitel and Sophia d’Antoine outline how the Department of Defense should address national security risks from Huawei. In Foreign Policy, Elisabeth Braw argues that it may not be altruism that underpins China’s foreign coronavirus aid.

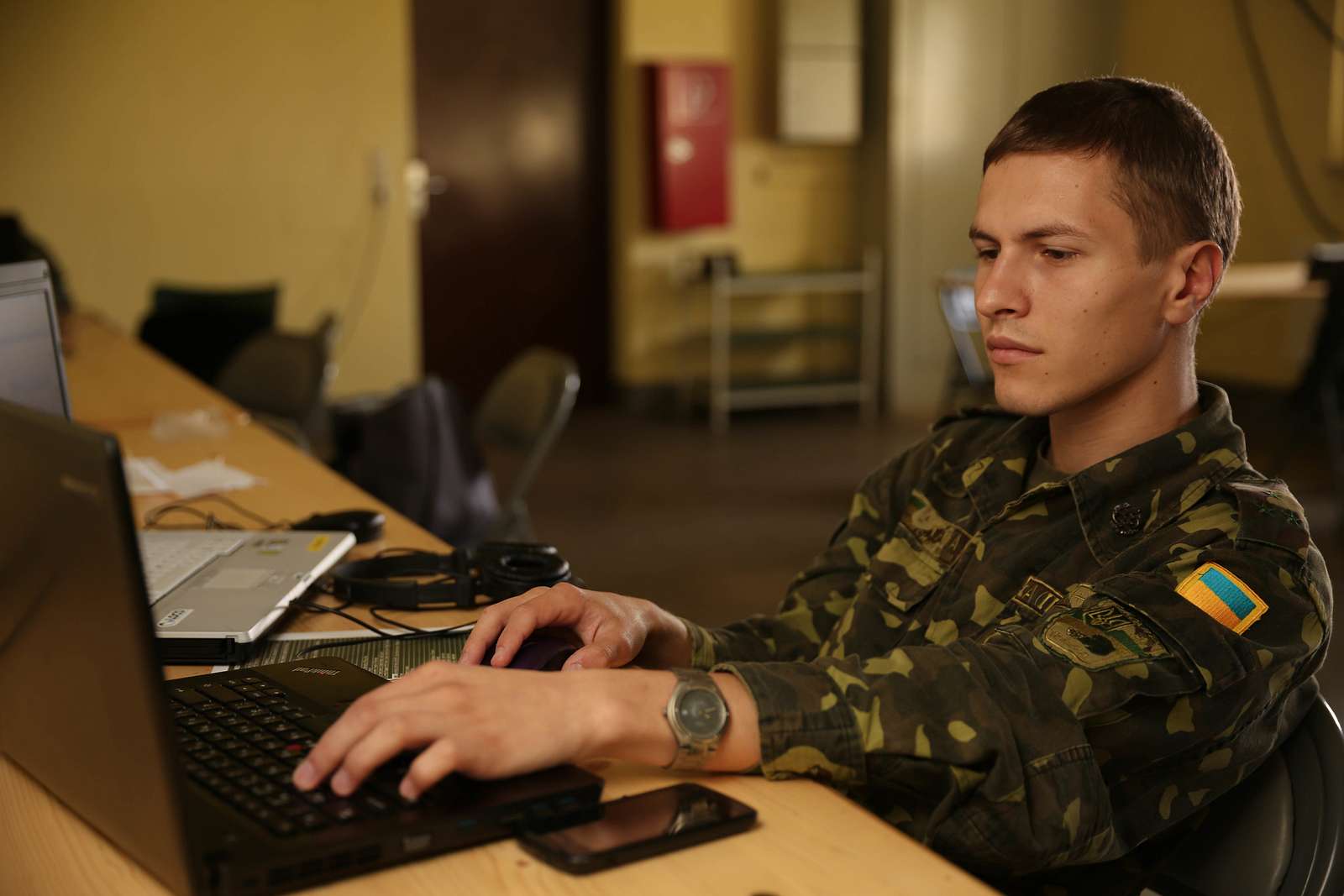

For Lawfare, Samm Sacks dissects the cybersecurity risks that China poses and how the U.S. should mitigate them. Jakob Bund discusses the strategy behind recent U.S. indictments of Chinese hackers. Justin Sherman explores the set of potential security risks involving Chinese video platform TikTok.